What Does Insurance Mean?

An Unbiased View of Insurance

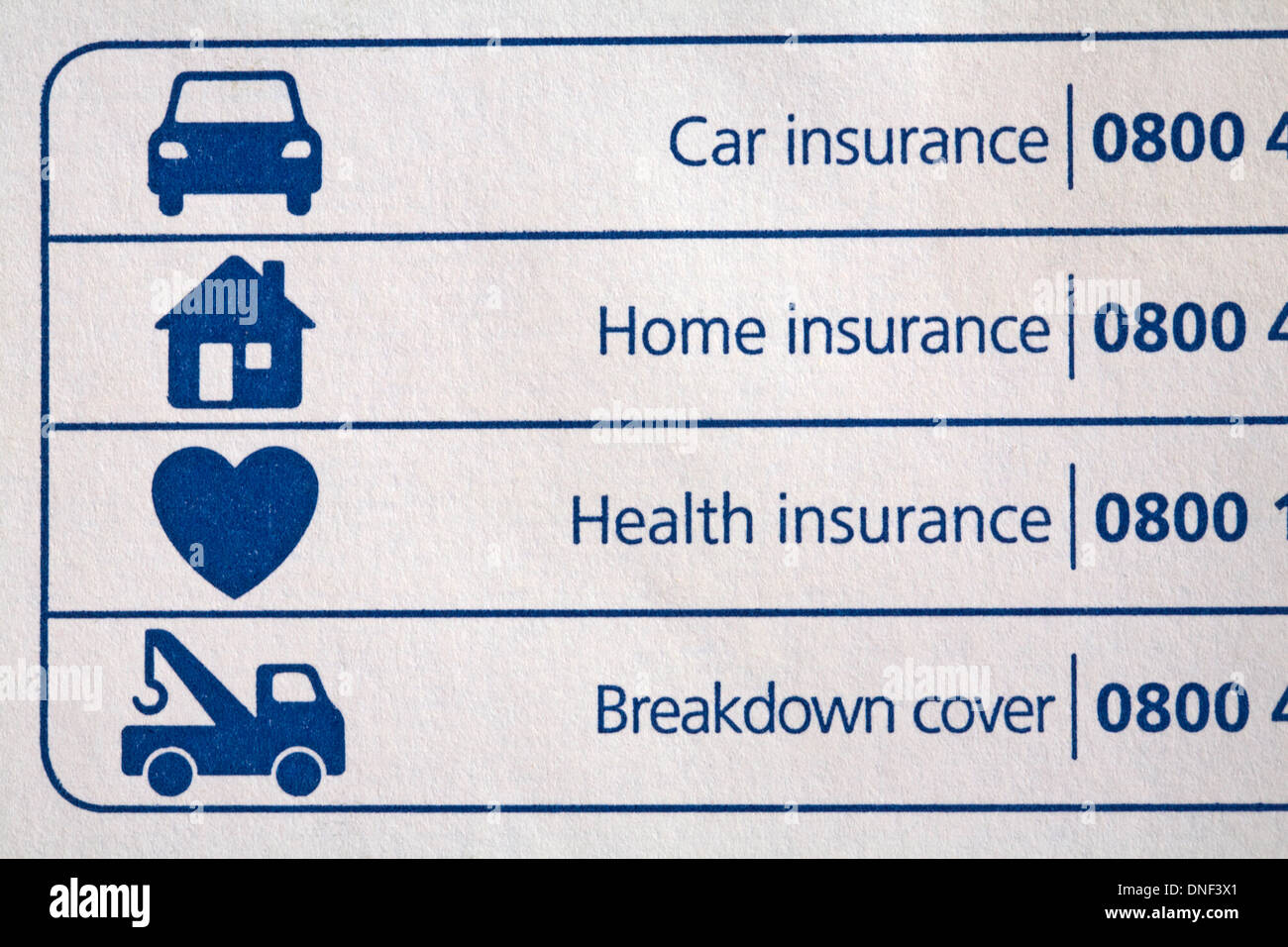

Table of ContentsHow Insurance can Save You Time, Stress, and Money.Things about InsuranceInsurance Things To Know Before You BuyInsurance - An Overview4 Easy Facts About Insurance Explained3 Simple Techniques For Insurance

There are countless insurance coverage options, as well as numerous monetary specialists will claim you need to have them all. It can be hard to establish what insurance policy you truly require.Variables such as kids, age, lifestyle, and employment benefits play a duty when you're building your insurance policy profile. There are, however, four sorts of insurance coverage that the majority of financial specialists recommend most of us have: life, health, vehicle, as well as lasting disability. 4 Kinds Of Insurance Policy Everyone Requirements Life insurance policy The best benefits of life insurance policy consist of the capability to cover your funeral service expenditures and also offer those you leave - Insurance.

The study also discovered that a quarter of families would certainly experience financial challenge within one month of a wage income earner's fatality. Simply described, whole life can be used as a revenue device as well as an insurance policy tool.

Insurance for Dummies

Term life, on the other hand, is a policy that covers you for a collection amount of time. There are other considerable distinctions in between the 2 kinds of insurance policy, so you might want to look for the advice of an economic professional prior to you choose which is best for you. Variables to take into consideration include your age, profession, and number of reliant youngsters.

, one in four employees entering the workforce will certainly end up being handicapped as well as will be incapable to work prior to they get to the age of retired life.

While health insurance policy pays for hospitalization and clinical expenses, you're still left with those everyday costs that your income usually covers. Several companies supply both brief- and also long-lasting impairment insurance as part of their advantages plan.

Getting My Insurance To Work

25 million authorities reported automobile crashes in the US in 2020, according to the National Freeway Website Traffic Safety Management. An estimated 38,824 people died in auto accident in 2020 alone. According to the CDC, automobile crashes are among the leading causes of death around in the United States and also around the globe.

3 million chauffeurs and also travelers were wounded in 2020. In 2019, financial costs of deadly auto crashes in the United States were around $56 billion. While not all states need drivers to have vehicle insurance, most do have guidelines relating to economic duty in the event check out here of a mishap. States that do need insurance conduct periodic arbitrary checks of motorists for evidence of insurance policy.

Insurance Can Be Fun For Anyone

Once again, just like all insurance, your individual conditions will establish the price of automobile insurance coverage. To make certain you obtain the ideal insurance policy for you, compare several rate quotes and also the insurance coverage provided, as well as inspect regularly to see if you receive reduced prices based upon your age, driving record, or the location where you live.

Life will certainly toss you a captain hook there's no doubt about that. Whether you'll have insurance coverage when it does is another issue completely. Insurance policy buffers you from unforeseen expenses like clinical expenditures. And also while lots of people understand that insurance is very important, not every person understands the different sorts of insurance coverage available and how they can assist.

Rumored Buzz on Insurance

kids). Those with dependents In case of death, a life insurance policy pays a beneficiary an agreed-upon quantity of money to cover the costs left by the deceased. A recipient is the individual or entity called in a plan that gets advantages, such as a partner. Keep your house and also maintain its residential or commercial property worth high, plus be covered in the instance of significant damages, like a residence fire.

Tenants Occupants insurance is used by renters to cover individual residential property in situation of damages or theft, which is not the duty of the proprietor. Make sure the price of your airfare is covered in instance of medical emergencies or various other occurrences that may create a journey to be cut brief.

Paying into pet insurance coverage may be extra affordable than paying a swelling amount to your veterinarian should your animal demand emergency medical treatment, like an emergency clinic see. Pet dog proprietors Family pet my blog insurance (mainly for dogs as well as pet cats) covers all or part of veterinary treatment when a pet is hurt or unwell.

Excitement About Insurance

More than 80% of without insurance respondents who had an emergency either could not afford the expenses or called for 6 or more months to pay off the expenses. While Medicare as well as Medicaid receivers were the least most likely to need to spend for emergency expenses, when they did, they were the least able to manage it out of the insured populace.